To finance restaurant equipment without burning through all your capital, you've got options like equipment loans, leases, or even specialized vendor financing. These aren't just about delaying a big payment—they’re smart strategies that let you get the gear you need right away while keeping cash on hand for day-to-day operations and growth. With the right financing, outfitting your Seattle kitchen with essential items like commercial refrigerators, deep fryers, and sandwich prep tables becomes a manageable, strategic investment.

Funding Your Kitchen Without Draining Your Capital

Let's be honest: outfitting a Seattle restaurant, bar, or food truck is a massive investment. Your success rides on having reliable, high-performance equipment, but dropping all that cash upfront can tie up the very funds you need to survive.

This is exactly why figuring out how to finance restaurant equipment is a crucial move for any Washington operator. It’s not just about buying stuff; it’s about setting up your business for the long haul without sacrificing your financial breathing room.

Whether you're launching a new Capitol Hill coffee shop and need those top-tier Seattle coffee shop refrigerators, or you're upgrading a Tacoma food truck with new deep fryers, knowing your financing options is the first step. The right approach lets you get the assets you need now—from commercial freezers to pizza prep tables—and pay for them over time as they start making you money. That’s how you keep your capital free for what matters most: inventory, marketing, and paying your crew.

Why Financing Is a Growth Engine

Good financing is more than just a loan; it's a tool for growth. It puts you on a level playing field, letting you use the best equipment without the crippling upfront cost.

And the demand for quality gear is only getting bigger. The global restaurant equipment market, valued at USD 4.8 billion in 2025, is on track to hit USD 10.2 billion by 2035. That's a 7.9% compound annual growth rate. This isn't just an abstract number—it shows that operators everywhere are investing heavily to stay competitive, and you should be, too. You can dig into more of these market insights over at Future Market Insights.

This trend reflects what we see on the ground for businesses looking for everything from Seattle bar equipment to efficient under counter refrigerators. Having the right gear, like reliable under counter freezers and powerful deep fryers, directly impacts your service quality and kitchen flow.

But many owners get stuck balancing the high price of new equipment against the gamble of unreliable used gear. If you're weighing your options, our guide on purchasing used commercial kitchen equipment offers some valuable perspective. Our goal is to bridge that gap by making new, dependable equipment accessible through simple, straightforward financing.

Choosing the Right Financing Path for Your Business

Okay, so you’ve decided you need to finance restaurant equipment. Now comes the tricky part: picking the right path. This decision can feel a bit overwhelming because the best choice really hinges on your specific business model, your cash flow, and where you see your restaurant in a few years. There’s no magic bullet here; it’s all about finding the perfect match for your operation.

Think about it this way. A brand-new Bellevue brewery is probably focused on preserving every penny for inventory and getting the word out. For them, leasing essential Seattle bar equipment—like under counter refrigerators and ice makers—is a no-brainer. The lower monthly payments keep working capital free, and they can upgrade to newer models when the lease is up without a massive financial blow.

Now, contrast that with an established Kent restaurant that has steady, predictable revenue and wants to overhaul its entire cook line. For them, taking out an equipment loan to buy new deep fryers and a commercial refrigerator outright is a smart investment. They’re building equity in assets that will serve them for years, and the interest is often tax-deductible, which is a nice little bonus.

Comparing Your Core Financing Options

Every financing route has its own trade-offs. A classic equipment loan gets you ownership, but you'll need a stronger credit history to get approved. Leasing, on the other hand, gives you flexibility but means you won't own the gear when the term is over.

A merchant cash advance can get you funds fast, based on your future sales, which is great for an emergency but often comes at a higher cost. Then there's vendor financing, like the programs we help facilitate. This is often the most straightforward option since it’s designed specifically for the equipment you’re buying, from sandwich prep tables and pizza prep tables to commercial freezers.

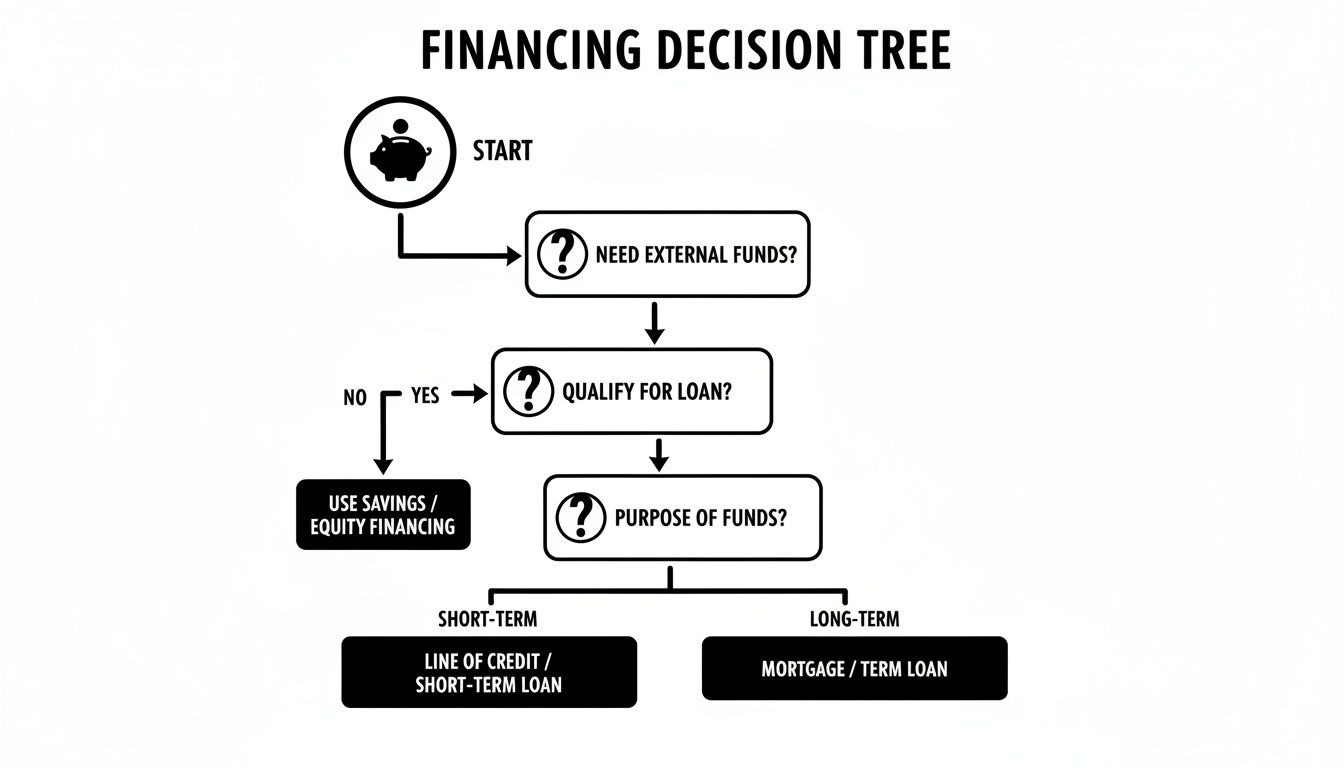

To help you sort through which path makes the most sense for your situation, this decision tree can walk you through the key questions to ask yourself.

As the flowchart shows, it really boils down to your timeline, credit situation, and whether owning the equipment outright is a top priority for you.

Real-World Scenarios for Washington Businesses

Let's ground this with a couple of real-world examples you might see right here in Washington.

-

Scenario 1: The Expanding Pizzeria: A beloved Spokane pizzeria is ready to open a second location. They need a big pizza prep table, several under counter freezers, and another deck oven. An SBA loan could be the perfect fit here. Sure, the application process is more intensive, but the great interest rates and longer repayment terms are ideal for a major expansion.

-

Scenario 2: The Capitol Hill Coffee Shop: A small coffee shop's trusty Seattle coffee shop refrigerators are on their last legs, and they want to add a new glass-door merchandiser to boost grab-and-go sales. Here, speed and simplicity are everything. A direct equipment lease or vendor financing lets them get the new units in the door fast with minimal paperwork and a low upfront cost, so they don’t skip a beat.

The right financing isn't just about getting a loan; it's a strategic tool. It should work with your growth plan, whether that means owning assets for the long haul or staying nimble with the option to upgrade as your menu and technology evolve.

Before you jump into applications, make sure you have a crystal-clear plan. Nailing down a list of essential items helps you ask for the exact amount of funding you need—no more, no less. You can use this handy commercial kitchen equipment checklist to get organized and make sure you haven’t forgotten any critical pieces for your operation.

Navigating the Application and Approval Process

Let’s be honest, applying to finance restaurant equipment can feel like a huge pain. But it doesn't have to be. If you break it down, the whole process is pretty straightforward. Lenders aren't trying to catch you out; they just need a clear picture of your business's health and where it’s headed.

The single best thing you can do? Get your documents in order before you even think about starting an application.

Think of it like getting your kitchen prepped for a chaotic Friday night dinner rush. You wouldn't dream of starting service without your mise en place ready to go. The same logic applies here. Walking in prepared shows you’re a serious operator who respects their time—and your own.

Gathering Your Essential Documents

Every lender is a little different, but most of them are going to ask for the same core documents. Having these organized in a folder on your computer will save you a ton of back-and-forth later.

Here's what you'll almost certainly need:

- Business Plan: This is non-negotiable, especially for new restaurants. It needs to lay out your concept, who you're selling to, and your financial projections.

- Financial Statements: If you're an existing business, get your profit and loss statements, balance sheets, and cash flow statements for the last two or three years.

- Tax Returns: Have at least two years of both personal and business tax returns ready. It’s a standard request.

- Bank Statements: Three to six months of recent business bank statements are usually required to show your current cash flow and stability.

- Equipment Quote: You'll need a detailed quote for the specific gear you want, whether it’s a commercial refrigerator, a new sandwich prep table, or a high-capacity deep fryer.

A strong application is more than just a pile of numbers; it’s a story. You have to connect the dots for the lender. Show them exactly how that new pizza prep table is going to boost your output by 20%, or how upgrading your Seattle coffee shop refrigerators will slash your energy bills and reduce spoilage. They're investing in your vision, not just a piece of stainless steel.

That kind of detail proves you’ve actually thought through the return on investment, which gives them the confidence they need to approve your loan.

The Timeline From Submission to Funding

So, how long does this all take? It really depends.

Simple leases or vendor financing for smaller items like under counter freezers can move incredibly fast—sometimes getting approved in just 24 to 48 hours.

On the other hand, more complex financing like a big equipment loan or anything involving the SBA will take longer. You could be looking at several weeks from the day you submit to the day the money hits your account. The keys here are patience and being ready to answer any follow-up questions from the lender immediately.

The U.S. restaurant industry is a beast, driving a huge chunk of the foodservice equipment market. Projections show North America holding a 42% revenue share in 2025 as the global market climbs to USD 46.12 billion. This growth is powered by over a million restaurants across the country constantly investing in new, more efficient equipment. Smart financing isn't just an option; it's a critical part of staying competitive.

Of course, a successful application starts with knowing exactly what your kitchen needs. For a deeper look at planning your layout and equipment list, our guide on setting up a commercial kitchen is a fantastic starting point. It'll help you make sure your financing request is perfectly aligned with your operational goals.

Securing the Best Possible Financing Terms

Getting an approval to finance restaurant equipment is one thing. But the real victory? Landing a deal that actually helps your business grow in the long run, not just one that gets a new commercial refrigerator in the door. It means looking past the monthly payment and getting honest about the total cost of the loan.

Your credit score—both personal and business—is the first thing any lender is going to scrutinize. A strong score, typically 700 or above, signals that you're a low-risk borrower. That's your golden ticket to better interest rates and more flexible terms. If your score is a little bruised, it's worth taking the time to polish it up. Focus on paying down existing debt and making every single payment on time before you start filling out applications.

Down Payments and Smart Comparisons

Here’s another tool you have: the down payment. While plenty of financing options are built for zero down, putting 10% to 20% down can make a huge difference in your interest rate. Lenders see it as you having "skin in the game." It lowers their risk, and they'll often reward you with a better deal on everything from under counter freezers to a full setup of Seattle bar equipment.

When you start getting offers, it's tempting to zero in on the monthly payment. Don't fall for that trap. You have to compare the Annual Percentage Rate (APR), which tells you the true cost of borrowing once all the fees are baked in. A loan with a lower monthly payment stretched over a longer term could easily cost you thousands more in interest. Always, always ask for a full amortization schedule so you can see the complete picture.

Getting the right financing terms is about protecting your long-term financial health. A couple of percentage points on an APR might not sound like a big deal, but over the life of a loan for essential gear like deep fryers or sandwich prep tables, it adds up to serious savings that go straight back into your pocket.

A Real-World Example: A Seattle Coffee Shop

Let's break it down with a practical scenario. Say you're opening a new coffee spot in Seattle and need to finance $20,000 for Seattle coffee shop refrigerators and a few under counter refrigerators. You get two offers, both for a five-year term.

- Offer A: 8% APR, which comes out to a $406 monthly payment.

- Offer B: 11% APR, with a monthly payment of $435.

The monthly difference is just $29. That seems pretty manageable, right? But let’s look at the total interest you'd pay over those five years:

| Offer | APR | Monthly Payment | Total Interest Paid |

|---|---|---|---|

| Offer A | 8% | $406 | $4,360 |

| Offer B | 11% | $435 | $6,100 |

By going with the lower APR, you save $1,740. That’s real money you could put toward marketing, a bigger opening inventory, or just a cushion for those unexpected startup costs. This shows exactly why it pays to fight for the best terms, not just the quickest approval.

How We Make Financing Simple

When you need to finance restaurant equipment, the last thing you want is a complicated, drawn-out process. I've seen it time and again—a great opportunity or a critical replacement gets held up by paperwork. That’s why we’ve built straightforward financing solutions directly into our service, designed specifically for Washington-based businesses. Our goal is to get you the gear you need with minimal fuss so you can get back to what you do best: running your restaurant.

Through our partnership with The Restaurant Warehouse, applying for financing is about as easy as it gets. You can get a quote and kick off the application right from our website, cutting out the typical back-and-forth and saving you precious time.

Financing Built for Washington Foodservice

Our program is tailored to the specific equipment we sell, which means the terms actually make sense for the assets you’re acquiring. Whether you’re outfitting a brand-new coffee shop in Capitol Hill or upgrading a bustling kitchen in Bellevue, our financing covers the workhorse equipment that drives your revenue.

We can help you get funding for our entire catalog, including:

- Commercial Refrigerators & Commercial Freezers: The absolute essentials, from massive reach-ins to compact models.

- Sandwich Prep Tables & Pizza Prep Tables: These workstations are the heart of countless delis and pizzerias, and we make them affordable.

- Seattle Bar Equipment: Think under counter refrigerators, under counter freezers, and the back bar coolers that keep service flowing.

- Seattle Coffee Shop Refrigerators: Glass-door merchandisers and display cases designed to move product.

- Deep Fryers & Cooking Equipment: The heavy-duty gear for your kitchen’s hot line.

Because our focus is so specific, the approval process is often much faster than what you’d find at a traditional bank. The lenders we partner with know the value and lifespan of commercial kitchen equipment inside and out, which helps them make quicker, more informed decisions.

The real benefit here is simplicity. We’ve removed the usual hurdles to help you get approved fast—often within a single business day. A broken freezer or an unexpected expansion opportunity shouldn't bring your business to a halt.

Your Direct Path to Equipment Funding

Getting started is simple. When you find the equipment you need on our site, you’ll see the option to apply for financing. The application is direct and just asks for basic information about your business. You won’t need to dig up a mountain of paperwork just to get an initial quote.

Once you submit your application, our partners get to work finding the best possible terms for you. We’re big believers in hands-on support, so if you have questions at any point, help is just a phone call or email away. This personal guidance ensures Washington restaurant owners can confidently get the funding they need to grow and thrive.

Your Restaurant Equipment Financing Questions Answered

When you're figuring out how to finance restaurant equipment in Washington, a lot of questions pop up. It's totally normal. Getting a handle on things like credit scores and the different types of equipment you can finance helps you make smart decisions that will set your business up for success.

Let's dive into some of the most common questions we hear from local restaurant owners just like you.

Can I Finance Equipment with Bad Credit?

Yes, you absolutely can. Don't let a rough credit history stop you from exploring your options. While a killer score will definitely land you the best rates, plenty of lenders specialize in working with business owners who've hit a few financial bumps in the road.

If your credit isn't perfect, an equipment lease might be easier to get your hands on, though you might see slightly higher interest costs. The best thing you can do is have an upfront, honest conversation with a financing partner. They can look at your specific situation and point you toward real, workable solutions. Seriously, even a small boost to your credit score before you apply can make a world of difference in the terms you're offered.

What Is the Difference Between a Loan and a Lease?

This is a big one, and it really boils down to one thing: ownership.

- An equipment loan means you borrow cash to buy the gear outright. It's yours from day one. As you pay it down, you build equity. This is a fantastic move for those workhorse pieces you'll rely on for years, like your main commercial refrigerators or heavy-duty deep fryers.

- An equipment lease is more like renting. You pay a monthly fee to use the equipment for a set amount of time. The payments are usually lower, and it makes upgrading to the latest and greatest models a breeze when your lease is up. Leasing is a great call when you want to keep more cash on hand or for tech-heavy items that get updated all the time.

Choosing between a loan and a lease isn't just about the numbers; it's a strategic move for your kitchen. A loan gives you a solid foundation of assets you own, while a lease offers the agility to adapt as your menu or technology changes—without a huge upfront investment.

How Much of a Down Payment Do I Need?

This can be all over the map. The down payment you’ll need depends on the lender, your credit, and how much the equipment costs. A 10-20% down payment is pretty standard for a traditional loan.

But here's the good news: many financing programs and leases are set up to require little to no money down. For a new restaurant or anyone trying to protect their cash flow, this is a huge advantage. That said, if you can swing a larger down payment, it can often score you a lower interest rate and shrink your monthly payments. It's always something to consider.

What Types of Equipment Can I Finance?

Pretty much anything you can imagine in a commercial kitchen. This is what makes financing so powerful—it lets you get the exact tools you need to bring your vision to life, from the front door to the back of the house.

You can get funding for all the essentials, including:

- Core refrigeration like commercial freezers and commercial refrigerators.

- Specialty prep stations, from sandwich prep tables to pizza prep tables.

- Everything for your beverage program, including Seattle bar equipment, under counter refrigerators, and Seattle coffee shop refrigerators.

- The real powerhouses of the cooking line, like deep fryers and commercial ovens.

Whether you're launching a new food truck in Tacoma or completely overhauling a full-service restaurant in Bellevue, financing is the tool that helps you get the assets you need to grow.

Ready to get your Washington kitchen set up with dependable, affordable gear? Seattle Restaurant Equipment has a massive inventory of new commercial-grade appliances, and we offer fast, free shipping across the state. Check out our equipment and see how straightforward our financing options are.